calculation of stamp duty malaysia

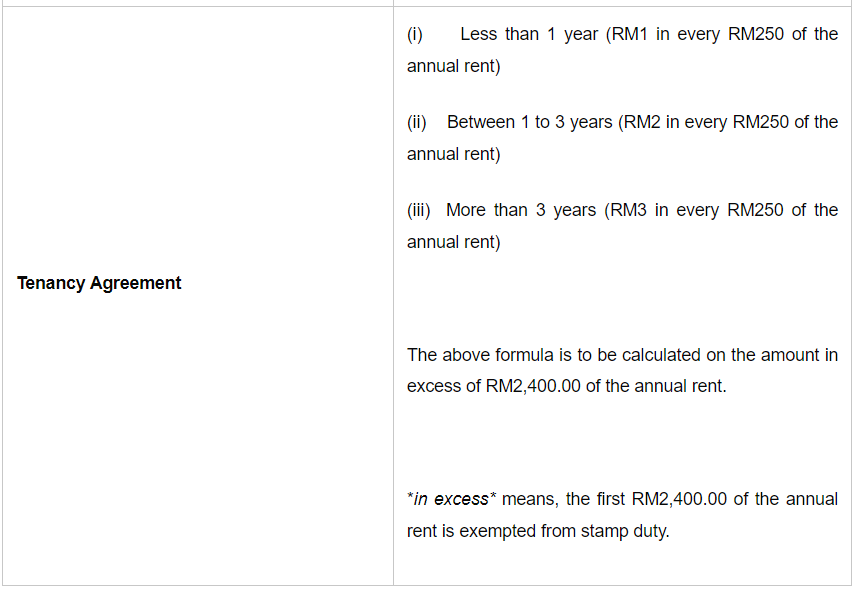

Stamp duty for Memorandum of transfer in Malaysia MOT Malaysia can be extremely pricey and do check out the chart below for the tier rate. Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400.

How To Calculate Stamp Duty For Tenancy Agreement How To Calculate Stamp Duty For Tenancy Agreement Original Video Https Youtu Be 1g9sscemjha Please Subscribe Share Our Youtube Channel For More

The Country of Origin of imported goods also plays a part in determining the applicability of a number of other trade policies such as TRQ preferential tariffs anti-dumping duty anti-subsidy duty etc.

. Individuals are exempt from land appreciation tax for selling residential properties and exempt from stamp duty for purchasingselling residential properties. The real estate tax rate is 10 of the rental value and the calculation of the rental value differs for residential units and non-residential units. TM Share Price Telekom Malaysia Berhad provides integrated telecommunications solutions in Malaysia and internationally.

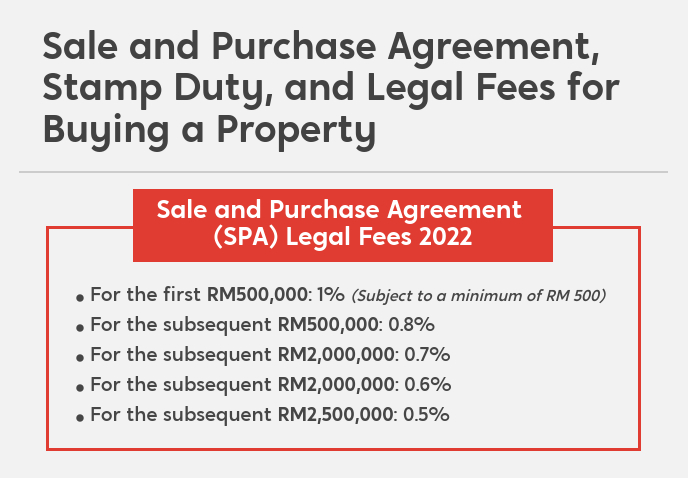

MORTGAGE TAX -- Tax on mortgages usually in the form of a stamp duty levied on the mortgage document. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. Home Malaysia Law Firm Malaysia Law Statutes Legal Fee Stamp Duty for Sale Purchase Agreement Loan.

For example the rules may provide that certain consequences will follow if the sole main or principal purpose of certain transaction is the reduction of. All classifieds - Veux-Veux-Pas free classified ads Website. Daily rest interest calculation for great savings.

Flexible repayment period of up to 25 years. Financing of your stamp duty and legal documentation fees. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

Depending on the type of property transaction you will encounter Buyers Stamp Duty BSD Sellers Stamp Duty SSD Additional Buyer Stamp Duty ABSD or stamp duty for rental properties. What are the changes to Stamp Duty when buying a UK second home or buy to let in the UK from 1st April 2016. The stamp duty is free if the annual rental is below RM2400.

6 to 30 characters long. ASCII characters only characters found on a standard US keyboard. The empty string is the special case where the sequence has length zero so there are no symbols in the string.

The stamp duty is free if the annual rental is below RM2400. Option for Redraw Facility for conventional loans with an approved amount of RM100000 and above. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

If your tenancy period is between 1 3 years the stamp duty fee is RM2 per RM250. Learn how to calculate stamp duty from a trusted source with PropertyGuru Finance and use our reliable. A foreign individual is subject to IIT VAT land appreciation tax and stamp duty plus some minor local taxes upon the disposal of real property in China.

SPA Loan Agreement quotation includes Legal fees amount Disbursement Fees 6 SST and stamp duty. What are you waiting for. Its easy to use no lengthy sign-ups and 100 free.

The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4. The process to convert inches to cm is quite straightforward. Stamp Duty Malaysia On A Loan Agreement Its also important to factor in the stamp duty owed for any loan agreement which may be entered into as part of a property purchase.

Currently first-time buyers are exempt from paying stamp duty along with anybody purchasing a property below 500000 in England. Come and visit our site already thousands of classified ads await you. The company primarily provides personal telephony services such as fixed lines.

If you have many products or ads. Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. Total Stamp duty is RM5000.

RM100000 x 1 RM1000. So for example if you want to 1 inch to cm you need to multiply 1 with 254. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. For East Malaysia the basic premium for a new car of each category Comprehensive rate for first RM1000 sum insured from the table above RM2030 for each RM1000 or part thereof on value exceeding the first RM1000. An example of Car Insurance Premium Calculation for Both Comprehensive and Third Party Fire Theft Coverage West.

Stamp duty calculation Malaysia 2020 Stamp Duty Exemption Malaysia 2022 The First Example If the property Purchase Price or Property value is RM300000 the property stamp duty will be as follows. Formally a string is a finite ordered sequence of characters such as letters digits or spaces. The stamp duty is free if.

In addition to the above stamp duty is. The majority of property buyers will be required to pay stamp duty if the property price is above the threshold. It offers information and communications services and solutions in broadband data and fixed-line for small and medium businesses and corporategovernment customers.

To convert inches to cm you must multiply the unit by 254. MOTIVE TEST -- Test often found in tax rules which are designed to prevent tax avoidance. Must contain at least 4 different symbols.

An attractive margin of financing of up to 150 including trade bills. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. Stamp duty is a standard part of buying a property and should be factored into your deposit.

Stamp duty Fee 1. The remittance is applicable for all contract notes from Jan 1 2022 to Dec 31 2026 for all stocks listed on Bursa Malaysia it said. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

From RM100001 to RM200000 2 RM200000 x 2 RM4000. Scroll down to see a sample calculation. Both quotations will have slightly different in terms of calculation.

The stamp duty is free if. RM100001 To RM300000 RM400000 Total stamp duty must pay is RM500000 So this is the total stamp duty then you can add legal fees disbursement fees valuation fees and other fees to estimate how much the cost of buying the house. Motor vehicle acquisition tax.

Stamp duty in Singapore is a type of tax that all homeowners must be familiar with. For First RM100000 RM100000 Stamp duty Fee 2. Calculate now and get free quotation.

Specific percentages of deductions are provided by the law to account for all the expenses incurred by the taxpayer including maintenance costs. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. Use our Stamp Duty Calculator to find out how much SDLT Stamp Duty Land Tax may be payable on your residential property purchase in England or Northern Ireland.

For the first RM100000 1. Therefore 1 inch 1 x 254 254 cm Here are. Import and export goods are reduced with or exempted from customs duties import VAT and consumption tax according to state regulations.

From the 1st April 2016 anyone purchasing a property in addition to their main home will pay an additional 3 SDLT for the first 125000 and 5 instead of 2 on the portion between 125001 and 250000 and 8 on the amount above 250001. Updated with the latest rates for September 2022 onwards. In the Budget 2022 announcement the government had proposed to raise stamp duty on share contract notes from 01 per cent to 015 per cent which is equivalent to RM150 for every RM1000.

Propertyx Malaysia Home Loan On The App Store

Ws Genesis E Stamping Services

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

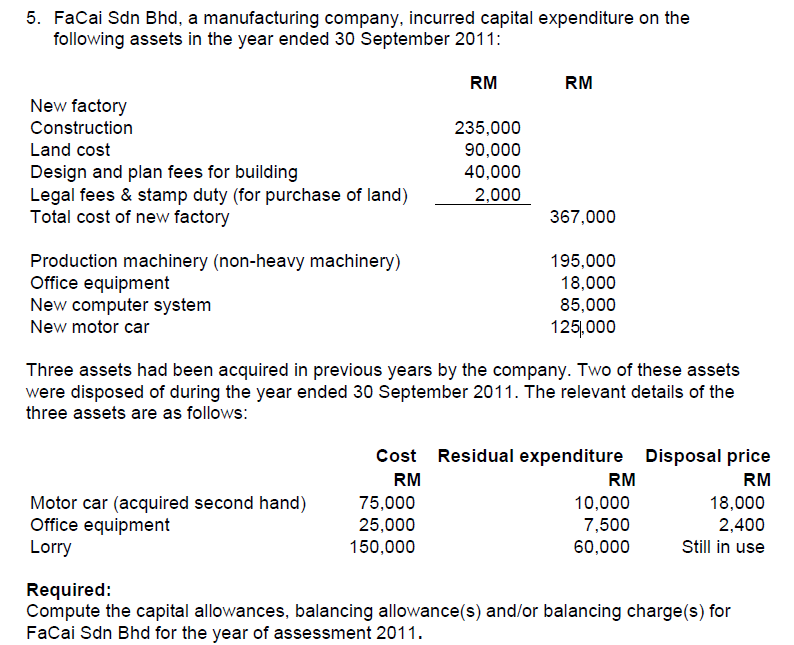

5 Facai Sdn Bhd A Manufacturing Company Incurred Chegg Com

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Stamp Duty Legal Fees And Lawyer Fee Mot Valuation Fee And Others Cost When Buying A House In Malaysia App Included Property Malaysia

Stamp Duty Legal Fees New Property Board

Best App For Calculating Legal Fees And Stamp Duty In Malaysia

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

How To Calculate Stamp Duty 2022 Malaysia Housing Loan

Best Home Loan Calculator In Malaysia With Legal Fees Stamp Duty Loanstreet

Faqs Perfection Of Transfer And Charge Publication By Hhq Law Firm In Kl Malaysia

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

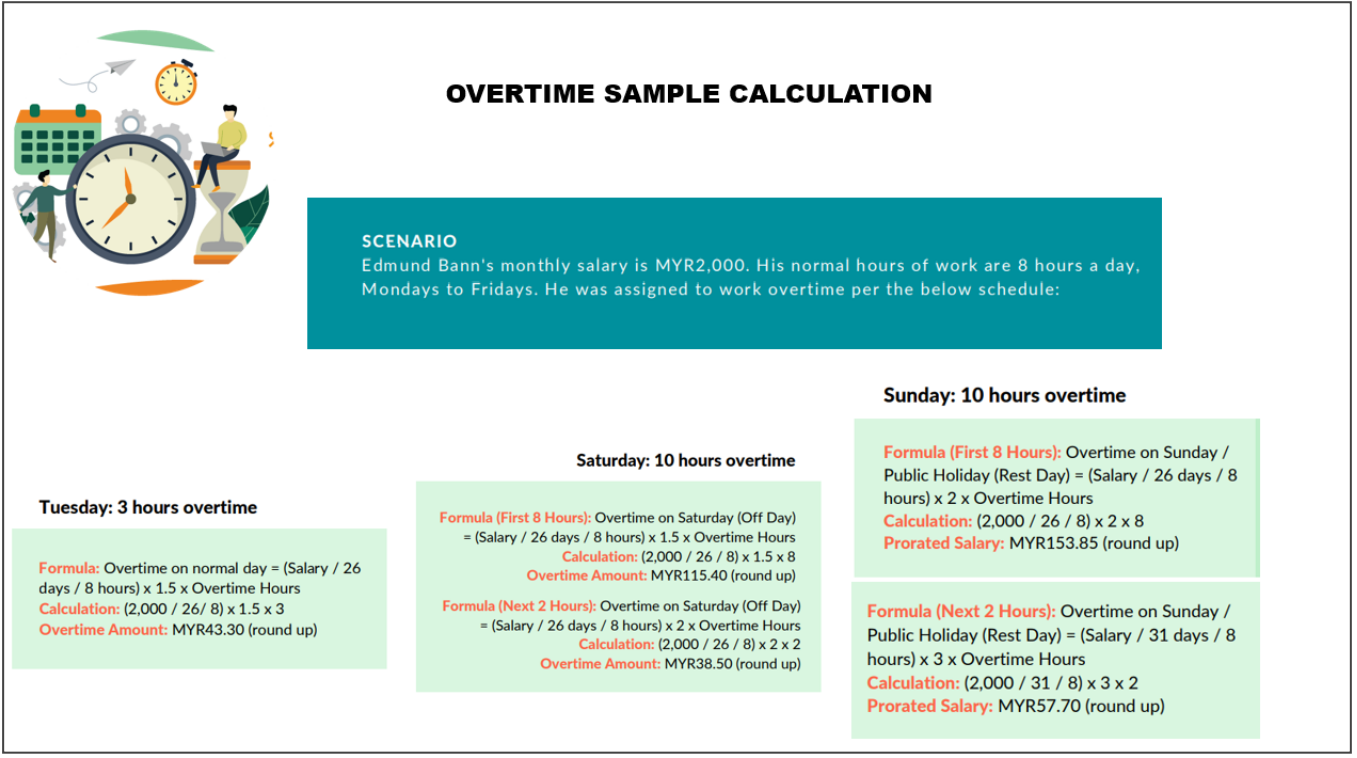

Everything You Need To Know About Running Payroll In Malaysia

Ws Genesis E Stamping Services

0 Response to "calculation of stamp duty malaysia"

Post a Comment